|

Continued from

FrontPage of Article

PERFORMANCE OF THE SINGAPORE ECONOMY IN SECOND QUARTER 2007 AND

OUTLOOK FOR 2007

Overall Performance

The Singapore economy expanded by 8.6% in 2Q07 following 6.4% in

1Q07. Growth on a seasonally-adjusted quarter-on-quarter annualised

basis increased to 14% in 2Q07 from 8.8% a quarter earlier.

Sources of Growth

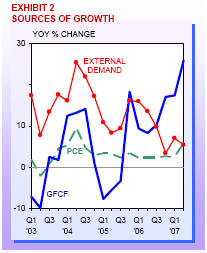

Total demand growth moderated to 6.8% from 7.7% in the previous

quarter. Domestic demand grew by 12% due to stronger growth in

private consumption and investments. External demand growth eased to

5.4%, due to slower growth in goods exports.

Sectoral Performance

Growth in the second quarter was led by the financial services and

construction sectors which experienced double-digit growth in 2Q07

(see Annex).

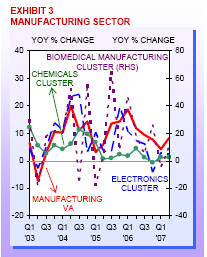

THE MANUFACTURING SECTOR grew by 8.3% in 2Q07, up from 4.4% in the

previous quarter. The transport engineering cluster continued to

expand strongly at 31% following a 23% increase in 1Q07. The

biomedical manufacturing cluster also recovered from a 5.1%

contraction in 1Q07 to register an increase of 11% in 2Q07.

Precision engineering, however, fell by 2.0% while electronics and

chemicals grew by 2.5% and 1.4% respectively during the quarter.

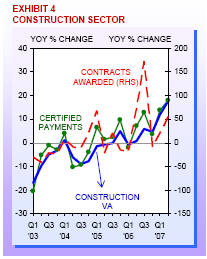

THE CONSTRUCTION SECTOR expanded by 18% in 2Q07, its strongest

growth since 3Q97. Growth momentum was robust, at 15%. Certified

payments increased by 18% in 2Q07, supported by strong growth in the

private residential, commercial and industrial segments as well as

public residential segment. Contracts awarded increased 55% in 2Q07,

due mainly to the rise in the private commercial and public

institutional segments.

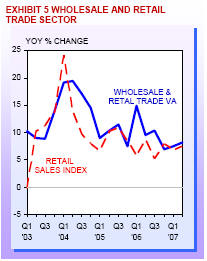

THE WHOLESALE AND RETAIL TRADE SECTOR expanded 8.2% in 2Q07 compared

with 7.5% in 1Q07. Retail sales grew by 7.5% in 2Q07, up from 6.8%

in 1Q07. While motor vehicles and food and beverage sales registered

weaker growth, better performance was seen in the furniture and

household equipment, optical goods and books, and watches and

jewellery segments. Excluding motor vehicles, retail sales rose by

11%, up from 6.9% in 1Q07. In the wholesale segment, growth of

non-oil re-exports moderated to 1.3%, down from 5.8% in 1Q07.

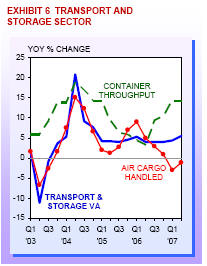

THE TRANSPORT AND STORAGE sector grew 5.5% in 2Q07, up from 4.3% a

quarter earlier. The sea transport segment saw faster growth on the

back of robust container throughput. However, growth of sea cargo

moderated from 10% in 1Q07 to 6.8% in 2Q07.

Growth in air transport activity was more subdued, slowing down in

2Q07. This was mainly due to a moderation in air passenger traffic

growth, from 6.9% to 5.5%. Air cargo contracted by 1.1%, a slight

improvement over the 3.0% contraction in 1Q07.

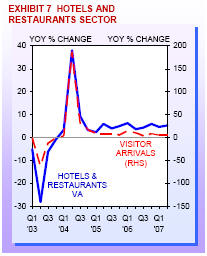

THE HOTELS AND RESTAURANTS SECTOR rose by 5.2% in 2Q07, slightly

higher than 4.8% in the previous quarter. Visitor arrivals for the

quarter grew by 4.9% compared with 5.5% in the first quarter. The

increase in hotel room revenue moderated from 22% in 1Q07 to 16% in

2Q07. The average occupancy rate of hotels remained high at 86%,

which is 2.5 percentage-points higher than the corresponding period

last year.

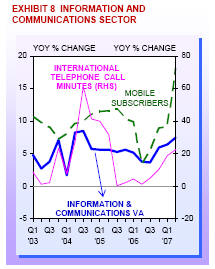

THE INFORMATION AND COMMUNICATIONS SECTOR grew 7.5% in 2Q07, up from

6.4% in the previous quarter. This was driven mainly by the

telecommunications segment while the IT segment saw some moderation

in activities. International telephone call duration grew by 22%

compared with 19% in 1Q07. The number of mobile subscribers also

expanded strongly by 18% in June, up from 9.2% in March.

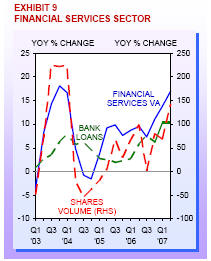

THE FINANCIAL SERVICES SECTOR saw robust expansion of 17% in 2Q07,

up further from 14% in 1Q07. Broad-based growth in the sector was

led by sentiment-sensitive clusters such as the stocks, shares and

bond brokers segment. Against the backdrop of the property boom, the

domestic banking industry continued to benefit from higher loans for

building and construction activities. The offshore banking sector

was also bolstered by robust regional demand for financial services.

THE BUSINESS SERVICES SECTOR expanded by 6.9% in 2Q07, similar to

the 6.8% in 1Q07. The sector was well supported by healthy

performances in business representative offices and professional

services. The broadening of growth in the real estate segment also

contributed to growth of the sector.

Labour Market

Total employment continued to grow strongly by 61,900 in 2Q07,

higher than 49,400 in 1Q07. All sectors added workers, led by

services with gains of 33,600 workers. Manufacturing and

construction also posted strong increases of 16,600 and 11,400

respectively.

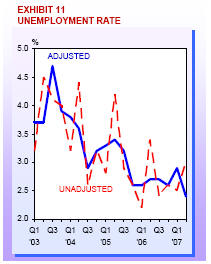

Reflecting the favourable economic conditions, the seasonally

adjusted unemployment rate fell to 2.4% in June 07 from 2.9% March

07. The number of workers retrenched in 2Q07 also dropped to 1,600,

from 2,000 in the previous quarter.

Labour Productivity

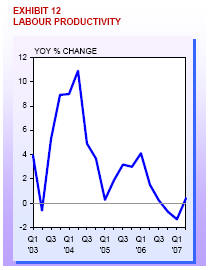

Overall labour productivity improved by 0.4% following a 1.3% drop

in the previous quarter. At the sectoral level, declines were seen

in hotels & restaurants (-5.4%), business services (-5.2%),

information & communications (-2.1%), other services (-1.4%) and

manufacturing (-1.0%). The sectors that saw positive productivity

growth were construction (6.4%), financial services (4.1%),

transport & storage (2.5%) and wholesale & retail trade (2.4%).

Business Costs

Overall unit labour cost (ULC) rose 5.7% in 2Q07, following a 5.9%

increase in the preceding quarter.

The unit business cost (UBC) of manufacturing rose by 1.9% in 2Q07,

following 3.3% the previous quarter. All three components rose, viz.

manufacturing ULC, services cost and government rates and fees.

External Trade

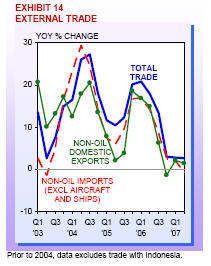

External trade expanded by 2.6% in 2Q07, slightly lower than the

2.9% gain in the previous quarter. Total exports grew 2.9% following

3.4% in the previous quarter while non-oil domestic exports (NODX)

rose by 1.5% in 2Q07, down from 2.1% in the last quarter.

The growth in NODX was due to higher non-electronics NODX growth

offsetting the drop in domestic exports of electronics. Non-oil

imports (excluding aircraft and ships) fell by 0.9%, down from a

growth of 2.0% in the preceding quarter. In volume terms, total

trade grew by 6.5% in the second quarter compared with 8.1% in the

first quarter.

Investment Commitments

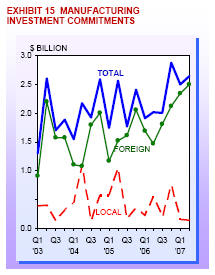

Fixed asset investment of $2.6 billion

was committed in the manufacturing sector in 2Q07, up from $2.5

billion in 1Q07. The largest investments were in the electronics

sector ($1.4 billion), followed by chemicals ($861 million) and

transport engineering ($167 million) respectively.

In terms of the local-foreign breakdown,

foreign investments amounted to 95% of the total amount while local

investments made up the rest.

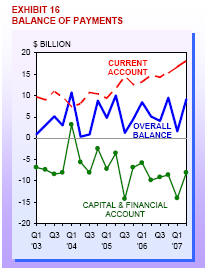

Balance of Payments

Singapore¡¯s overall balance of payments surplus rose $7.6 billion in

2Q07 to reach $9.1 billion. This was due to an increase in the

current account surplus and a reduction in net outflows from the

capital and financial account. Consequently, Singapore¡¯s official

foreign reserves rose to $221 billion, equivalent to 6.9 months of

merchandise imports during the quarter.

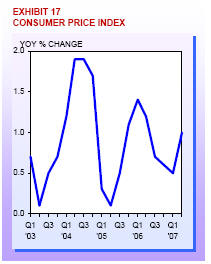

Consumer Price Inflation

On a year-on-year basis, the CPI was 1.0% higher in 2Q07, compared

with a 0.5% gain in the last quarter. Among the major categories of

consumer expenditure, recreation costs posted the largest gain

(3.1%) due to higher holiday travel costs. This was followed by

healthcare (3.0%), food (1.4%), and transport & communications

(1.1%). Both education & stationery and clothing & footwear saw a

0.2% increase in prices. Meanwhile, housing costs declined by 1.4%,

reflecting lower electricity tariffs and housing maintenance

charges.

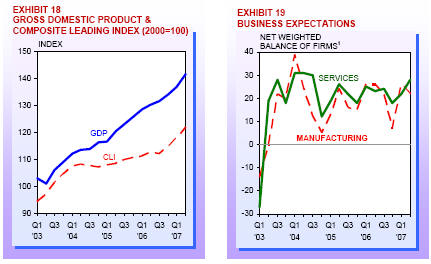

Outlook for 2007

The global economic environment continues to be healthy. Economic

growth in the US remains intact. The Japanese and EU economies

continue to recover on the back of strong domestic demand and firm

business sentiment. Prospects in Asia remain robust, with the

Chinese economy growing at a rapid pace. But some downside risks

remain, such as a large negative spillover from the US housing

market and potential negative supply shocks in oil. Reflecting the

favourable external environment, both manufacturing and services

firms continue to expect better business conditions in the next half

of the year. The consensus forecasts in the market for Singapore¡¯s

GDP growth are creeping upwards while the composite leading index

continues to increase.

Taking into account the above factors, the Ministry of Trade and

Industry has raised the full-year GDP growth forecast for 2007 from

5.0-7.0% to 7.0-8.0% The improved outlook reflects higher growth in

financial and business services, manufacturing, and construction.

The driving factors underpinning the higher growth forecast are

broad-based: strong global demand in the biomedical, aerospace and

marine industries, robust regional demand for financial services,

and a buoyant domestic property market.

¡¡

-------------------

1 The y-axis of the chart on business expectations

represents the net weighted balance of companies that predict an

improvement in business situation. This is derived from the weighted

percentage of companies in the survey that predict better business

minus the weighted percentage of companies that predict worse

business.

Source:

www.mti.gov.sg Press Release

10 Aug 2007

|