|

Continued from

FrontPage of Article

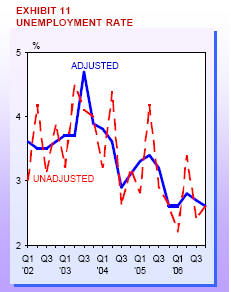

Labour Market

Total employment grew strongly by 48,800

in 4Q06, higher than the 43,000 in 3Q06.

The bulk of the gains continued to come

from services (32,300) while manufacturing and construction also

posted increases in employment. During the quarter, 3,000 workers

were laid off, higher than the 2,435 retrenched in 3Q06.

Seasonallyadjusted unemployment rate fell slightly from 2.7% in

September 2006 to 2.6% in December 2006.

Over the year, total employment creation

reached an all-time high of 173,300, surpassing 113,300 in the

previous year.

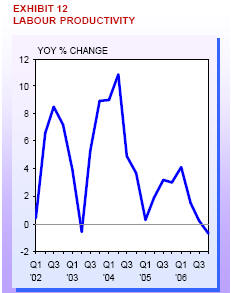

Labour Productivity

Labour productivity in 4Q06 declined by

0.7% as employment gains outpaced GDP growth.

At the sectoral level, business services

saw the largest drop in productivity levels (-5.1%), followed by

construction (-3.3%), information and communications (-3.0%), hotels

and restaurants (-2.4%) and manufacturing (-0.7%) sectors. On the

other hand, the other sectors registered positive growth in

productivity, viz, wholesale and retail trade (1.8%), financial

services (1.6%) and transport and storage (0.5%).

For 2006, productivity growth slowed

from 2.1% in 2005 to 1.2% in 2006.

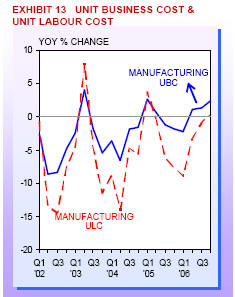

Business Costs

Unit labour Cost (ULC) of the overall

economy increased by a marginal 0.1% in 4Q06, following a 1.5%

increase in 3Q06.

For the whole of 2006, ULC was down by

0.5%, a smaller decline compared to the previous year. Unit business

cost (UBC) in the manufacturing sector went up by 2.4% in 4Q06. Over

2006, UBC rose by 0.6%, after remaining flat a year earlier. The

3.6% fall in manufacturing ULC was offset by the increases in

services costs (mainly utilities and rental) and government rates &

fees (mainly property prices).

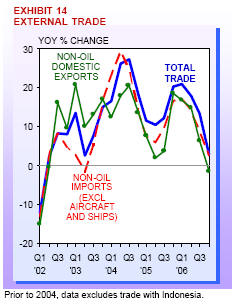

External Trade

Singapore¡¯s external trade expanded by

3.0% in 4Q06, down from the 13% in 3Q06.

Growth of total exports slowed to 2.0%

after a 12% increase a quarter earlier, as both oil and non-oil

domestic exports (NODX) declined while growth of re-exports

moderated. Non-oil imports (excluding aircraft and ships) rose 2.6%,

after posting 8.5% growth in 3Q06. In volume terms, total trade

increased by 5.2%, compared to 11% in the previous quarter.

Over 2006, external trade expanded by

13% while NODX growth edged up to 8.5% from 8.2% in 2005.

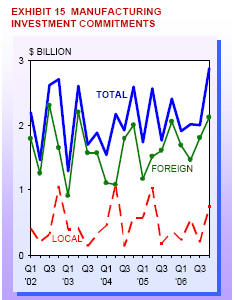

Investment Commitments

In 4Q06, manufacturing investment

commitments totalled $2.9 billion in terms of fixed assets. This

brought total manufacturing investment commitments for the whole

year to $8.8 billion, a 3.8% increase over the previous year. When

fully operational, these commitments would generate a value added of

almost $7 billion per annum and create 16,200 jobs, of which 56%

would be for skilled workers.

Total business spending commitments in

services promoted by EDB amounted to $714 million in 4Q06. For the

whole of 2006, commitments in these services industries were $2.8

billion, up from $2.5 billion a year earlier. When fully realised,

these commitments would generate a value added of $6.5 billion per

annum and create 10,600 jobs. 77% of these jobs would be for skilled

workers.

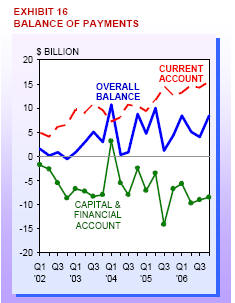

Balance of Payments

Singapore¡¯s overall balance of payments

registered a larger surplus of $8.5 billion in 4Q06 compared with

$4.0 billion in the previous quarter.

This brought the overall balance of

payments for the whole of 2006 to $26 billion, compared to $20

billion in 2005. This largely reflected the larger current account

surplus which offset the capital and financial account outflow

during the year. Consequently, Singapore¡¯s official foreign reserves

rose to $211 billion as at end-2006.

Consumer Price Inflation

The CPI rose by 0.6% year-on-year in

4Q06, compared to 0.7% in 3Q06.

The categories which saw the largest

increase were food (1.6%) and education & stationery (1.5%), and

housing (1.3%). However, prices of clothing & footwear dipped

slightly (-0.2%) while costs of transport & communications fell by

1.6%. For the whole year, consumer price inflation rose 1.0%, up

from 0.5% in 2005. Among all the categories, housing cost registered

the largest annual increase (2.7%), due mainly to higher electricity

tariffs.

¡¡

Outlook for 2007

The global economic conditions have

improved over the last few months. In the US, fears of the housing

market correction spilling over to the wider economy have subsided

with a pickup in housing sales. Prospects for the EU are healthy,

supported by strong business confidence. In Asia, China and India

are expected to see continued strong growth, while the outlook for

Japan remains favourable on the back of stronger corporate profits.

Oil prices have fallen from its peak in

2006 amid weeks of mild winter weather in the US and larger than

expected increases in oil inventories. In the electronics industry,

the inventory correction is improving. Research house Gartner has

forecast worldwide semiconductor sales to grow by a healthy 9.2% in

2007, following the 10.4% growth in 2006.

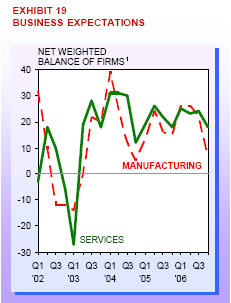

1 The y-axis of the chart on

business expectations represents the net weighted balance of

companies that predict an improvement in business situation. This is

derived from the weighted percentage of companies in the survey that

predict better business minus the weighted percentage of companies

that predict worse business.

On the domestic front, forward looking

indicators point towards continued growth in the next few quarters.

The composite leading index recovered from a dip in the third

quarter, rising to its highest level in the fourth quarter. The

latest surveys of business expectations also show that firms in the

manufacturing and services remain optimistic about business

conditions in the next 6 months.

Although the economic outlook is

generally positive, some downside risks persist. An Avian flu

pandemic threat has resurfaced as a growing number of countries

reported cases of infection in birds in recent weeks. Other

uncertainties include the disorderly unwinding of global imbalances,

terrorism and the vulnerability of oil prices to supply shocks.

Taking into account the above factors,

the Ministry of Trade and Industry has revised the 2007 economic

growth forecast from 4.0-6.0% to 4.5-6.5%.

Source:

www.mti.gov.sg News Release 15 Feb

2007

¡¡

|