|

CHARTS

1 - 9

Annex

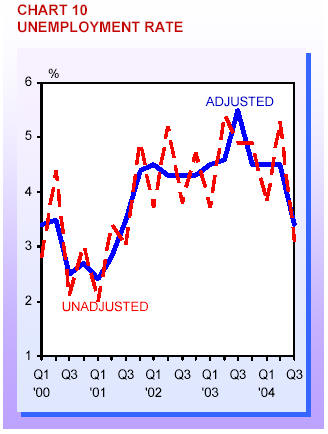

Labour Market

Total employment

rose by 16,600 in 3Q04, the strongest quarterly gain in three

and a half years. Employment in both the goods producing and

services producing industries grew more strongly than in 2Q04. A

total of 7,200 jobs were added in the goods producing

industries, compared with 2,900 previously. The services

producing industries added 9,400 workers, higher than the 8,000

added in the earlier quarter. Retrenchments also eased to a new

low, numbering 1,700 – a reduction of 17% from the previous

quarter. Strong employment creation led to a significant decline

in unemployment. The seasonally-adjusted unemployment rate fell

to 3.4%, from 4.5% in June.

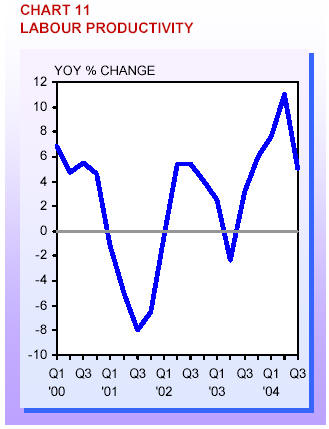

Labour

Productivity

The moderation of

economic growth in 3Q04 led to a slower rise of total labour

productivity of 5.0%, compared with the 11.0% recorded in 2Q04.

The construction sector suffered the largest fall in labour

productivity, declining by 6.8%. The business services and

financial services sectors saw smaller declines of 1.1% and 0.5%

respectively. The largest gains were seen in the wholesale and

retail trade sector (12.9%), transport & communications sector

(7.7%), and the manufacturing sector (5.6%).

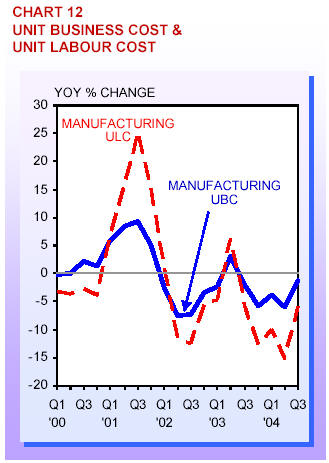

Business Costs

The unit labour cost

(ULC) index continued its downward trend, posting its fifth

consecutive decline of 4.9% in 3Q04, after falling by 10.0% in

the second quarter. The unit business cost index (UBC) of

manufacturing posted a smaller drop of 1.3% in 3Q04, compared to

the 5.9% decline in the quarter earlier. During the quarter, the

manufacturing ULC fell by 5.8%, after falling by 15.3% in the

previous quarter. Services cost posted a rise of 1.4%, as the

weighted rise in the costs of trade and transport, financial

services and other services outweighed continued declines in

premise rentals, warehousing rates and telecommunications

charges. Government rates and fees also rose by 4.5%, up

slightly from the 4.4% gain recorded 2Q04.

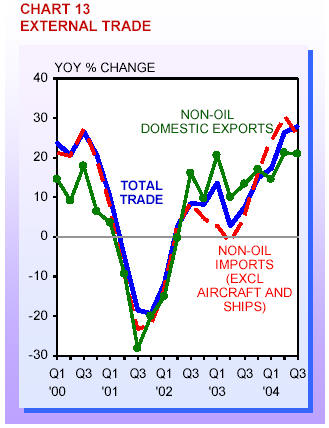

External Trade

Singapore’s external

trade grew a brisk 27.8% in 3Q04, following the growth of 26.5%

in 2Q04. Total exports expanded by 25.2%, on the back of a 25.7%

gain in 2Q04. This mainly reflected the robust growth of

domestic exports, which rose to 25.3% from 22.8% in 2Q04. The

rate of NODX growth rose to 20.8%, from 21.1% in 2Q04. On the

other hand, the rates of growth in re-exports and non-oil

imports (excluding aircraft and ships) moderated from the

previous quarter. In volume terms, total trade continued to turn

in a strong performance of 25.0%, after a 26.0% rise a quarter

earlier.

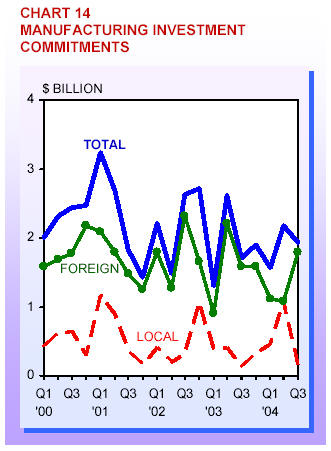

Investment

Commitments

Fixed asset

investments amounting to $1.9 billion were committed in the

manufacturing sector in 3Q04, down from $2.2 billion in 2Q04.

When fully implemented, these projects are expected to generate

a value added of $1.3 billion and create about 2,300 jobs, of

which 53% are for skilled professionals and workers. Investment

commitments in the services industries promoted by EDB in 3Q04

amounted to $511 million in total business spending. Upon

realisation, these projects will generate a value added of $826

million and create about 2,300 jobs, of which 81% are for

skilled professionals and workers.

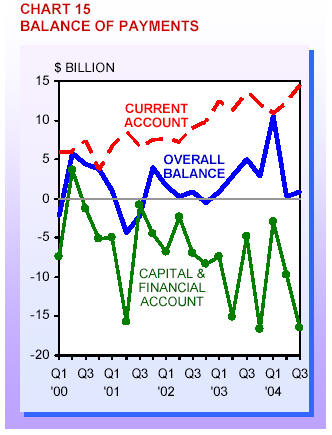

Balance of

Payments

The current account

surplus rose to $14.4 billion in 3Q04, up from $12.2 billion in

2Q04, as a result of higher surpluses in both the goods and

services accounts, even as the income balance recorded a larger

deficit. The net outflow in the capital and financial account

increased to $16.4 billion, up from $9.7 billion in 2Q04. This

largely reflected the rise in direct investment abroad.

Singapore's overall

balance of payments turned in a larger surplus of $0.8 billion

in 3Q04, compared to $0.3 billion in 2Q04. Nevertheless, the

official foreign reserves fell to $173 billion in the quarter

(equivalent to 7.8 months of current imports), from $175 billion

in the previous quarter.

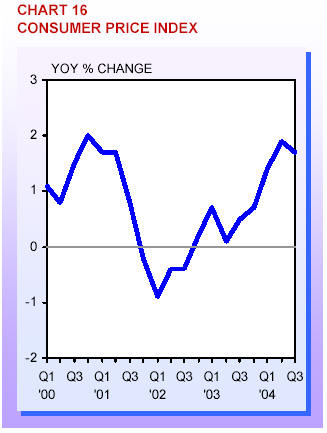

Consumer Price

Inflation

The CPI moderated to

1.7% in 3Q04, down slightly from 1.9% in 2Q04. Costs of

healthcare (5.9%) and education (3.9%) saw the largest gains.

Both the cost of food and miscellaneous items rose by 2.3% each.

The higher food prices were due to the recent poultry ban. The

cost of transport & communications also increased by 1.8%, as a

result of dearer electricity and petrol due to higher oil

prices. Helping to keep a lid on inflation, clothing prices and

housing cost declined by 0.5% and 0.3% respectively.

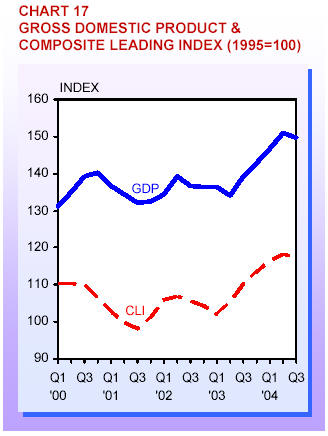

Outlook for 2004

and 2005

The Singapore

economy expanded by 9.1 per cent in the first nine months of

2004. Other than strong external demand for Singapore’s exports,

which accompanied the exceptional global economic growth this

year, the headline growth figure also reflected the economic

recovery from the impact of SARS.

External demand is

expected to remain supportive of economic growth in the

near-term. While the rate of global economic growth is expected

to ease in 2005, the IMF has projected that it would remain well

above levels seen between 2001 and 2003. The robust rates of

growth seen in the US and in Japan this year are likely to be

followed by growth at more sustainable rates, driven mainly by

improving labour market conditions in these economies. Economic

growth in the EU is also seen to moderate slightly next year, as

exports grow at an easier pace.

Similarly, economic

growth rates in key Asian economies are projected to ease in

2005. China, an important driver of global economic growth in

2004, is likely to succeed at achieving more sustainable rates

of economic growth in the next few quarters.

Slower growth is

also expected in the other major Asian economies, as the pace of

export growth eases in line with more moderate world demand for

electronics. Worldwide semiconductor sales are expected to

remain healthy for the rest of 2004, but growth will likely slow

sharply in the following year.

An important risk

factor to economic growth in 2005 is developments in oil prices.

Due to the small spare capacity in the oil industry, a

significant production disruption in any of the key producer

countries could send prices sharply higher. While the world

economy is better able to handle the impact of higher oil prices

than in the 1970s, further increases could dampen growth

nevertheless.

On the domestic

front, the recent improvement in the unemployment situation and

higher asset prices should provide support for domestic

consumption going forward. Growth of domestic investment,

however, is likely to ease, partly due to the slowdown in global

electronics demand. Forward looking indicators in Singapore are

also pointing to slowing growth in the near term, reflecting the

uncertain outlook for global economic conditions.

Barring unforeseen

circumstances, the MTI has narrowed the 2004 economic growth

forecast from 8.0-9.0 per cent to 8.0-8.5 per cent. The

narrowing of the forecast to the lower band reflects the slower

growth in the third quarter as a result of recent developments

such as lower-than-expected biomedical output as well as the

uncertainty of higher oil prices. It also reflects the

possibility of a further moderation of growth in the fourth

quarter. For 2005, the preliminary forecast for economic growth

remains at 3.0-5.0 per cent, in line with an expected

deceleration of the global economy and falling semiconductor

sales.

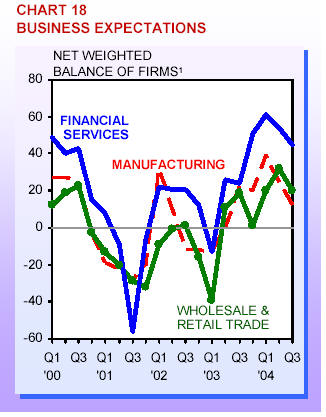

1 The

y-axis of the chart on business expectations represents the net

weighted balance of companies that predict an improvement in

business situation. This is derived from the weighted percentage

of companies in the survey that predict better business minus

the weighted percentage of companies that predict worse

business.

Source:

Ministry of Trade and Industry

Press Release 17 Nov 2004 |